Does financial literacy avoid economic crises?

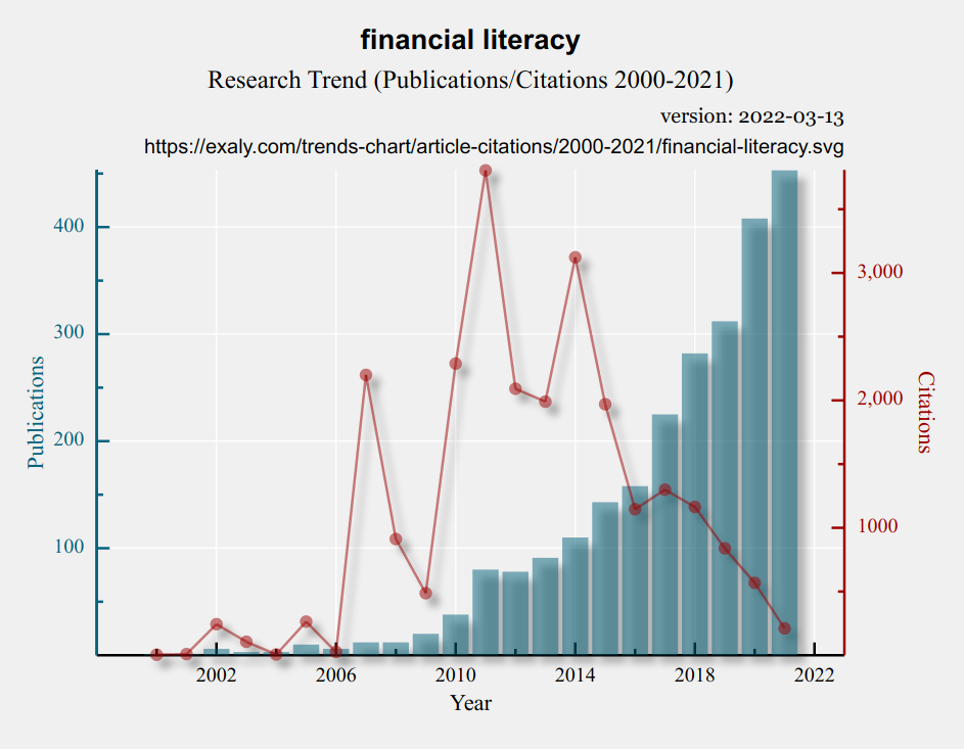

Since the 2008 global crisis, a great deal of attention has been paid to the concept of financial literacy and financial inclusion. It is evident from the rapidly growing number of publications in scholarly journals.

The reason is that the customers were ultimately blamed for failing to repay their mortgages in the United States. It was indeed a multidimensional phenomenon due to the complexity of the underlying financial system. However, it was easy to stress the financial illiteracy of people who were enjoying the rare opportunity of subprime mortgages because they did not foresee their inability to pay their monthly payments when the wind of financial change blew.

Studying financial literacy and financial inclusion

For four years of my PhD research at SOAS, I studied the dependence on financial literacy and financial inclusion. I came to the conclusion that we are missing the root of the problem, i.e., a broken financial infrastructure. Without going into technical details and jargon, this problem has emerged on two levels:

- Policy Makers

- Lenders

Policy Makers

The monetary policies of the central banks attempt to push people in the direction that benefit the economy as a whole. There is absolutely no consideration of personal finance in the equation. For instance, the financial regulators safeguarded the mortgage rules after the 2008 crisis, and since the outbreak of COVID-19, the policies were reversed. In other words, low-income people should not be trusted in the aftermath of the crisis, but they are trustworthy now again. I do not intend to object to the importance of economic recovery or the Keynesian economy here.

Still, my point is that we cannot design the macroeconomy without considering the microeconomy. We cannot treat individuals as pieces of chess with predefined functionality. The individuals react financially and psychologically, and thus, the reaction of the economy as a whole is not necessarily what macroeconomically predicted.

Lenders

Lending may seem mere business, but it is more of a club in practice. Parts of the society are members of this club and have access to a wide range of financial services, and some parts are temporary members during the quantitative easing. And some parts, of course, are never allowed to the party. It may seem cynical, but when looking at the mortgage eligibility criteria, it does not make sense at all.

Lending criteria

Technically, lenders simply need to ensure that their money is paid back. Here in the UK, almost all lenders have the same criteria. You merely need three months of payslip, and if there is nothing murky about your credit history, you are eligible for roughly five times your salary. It makes sense neither mathematically nor psychologically. If you have worked the last three months in the past ten years, this confirms you have a stable income for the next 20 years to pay your mortgage; but if you had a steady income in the past ten years but not the last three months, you cannot be trusted to have a job in the future.

If you put a 50% down payment, you are still not eligible for a mortgage without a stable income in the last three months. The housing price has never fallen by 50%. The lender has its guarantee, and there is no chance that someone risks losing their 50% down payment. When you put all these cases, you will find that it is not a business but a club. Of course, I am still puzzled why the membership fee is three months of employment.

Role of financial literacy in the economic crisis

Returning to the original argument about the role of financial literacy in the economic crisis, the reason is that the wrong people are admitted to the club. It is not a matter of affordability at all, but psychology and financial behaviour. When someone’s income falls, there are two types of financial behaviour. Some people will not sacrifice their beer budget to pay their mortgage, and some will sacrifice even their food. It is not difficult to distinguish these groups. Someone who has never missed their rent in the last ten years most likely will not miss their mortgage payment under any circumstance. And someone who has always struggled with their landlord is likely to ignore the mortgage payment in a time of crisis.

About the author

Maryam Sholevar has both academic and business experiences over a broad range of topics in the realm of banking and finance. She holds a BSc in Natural Resources and an MBA, during which she focused on analysing customer loyalty. Before joining SOAS, she worked as a lecturer at Jimma University, Ethiopia, where she received several awards of appreciation for her novel teaching methods. Her research has an emphasis on understanding the impact of financial literacy on strengthening Financial Inclusion (FI) in low-income countries.