Nothing new under the sun: The capital markets of Manila and the financing of the Pacific Trade, 1660-1820

Key information

- Date

- Time

-

5:00 pm to 7:00 pm

- Venue

- PWW (Senate House)

- Room

- S116

About this event

The SOAS History seminar returns with an exciting lineup of speakers for April/May 2024. Recognising the deep and uneven impact of the Covid pandemic on the academic community and research culture, our seminar this term will focus on engaging and supporting late-stage PhD students and Early Career Researchers.

Speaker

Juan Rivas-Moreno (LSE).

All our speakers are ECRs in History based in and around London and while the seminar is open to all we would like to extend a particularly warm invite to all doctoral students and ECRs at SOAS and other local institutions to join us for these in person sessions, and for drinks and refreshments after the talks.

Abstract

The start of direct trade between Europe, Asia, and America in the late 15th century represented challenges of unprecedented magnitude that required equally unprecedented solutions. The literature has emphasized the role of institutional innovations, embodied in the joint-stock corporation and the emergence of impersonal financial markets, in overcoming these challenges. In doing so, it has often established a causal relationship between the onset of global trade and the birth of modern capitalism (Wallerstein 2016).

The case of the Pacific exchange between Asia and America (1571-1821), the longest direct maritime trade route in the Early Modern world, shows instead an alternative approach, through which capital markets located in Spanish Manila emerged from the adaptation of instruments and religious organizations to the commercialised context of the European presence in Southeast Asia. Using the first reconstruction of the capital market of Manila in conversation with the market structure of the Pacific silver trade, this paper shows how Manileños used endowment funds, religious brotherhoods, and Ancient investment instruments like the sea loan to create financial markets capable of originating large volumes of working capital and of mitigating the principal-agent problems. The Manila capital market qualifies the notion that only a institutional break with the past could provide the necessary framework for intercontinental trade, and begs us to look more closely at differences between markets.

Contact:

Please feel free to contact the convenor, Eleanor Newbigin (en2@soas.ac.uk), for more information.

Open to all, no registration required.

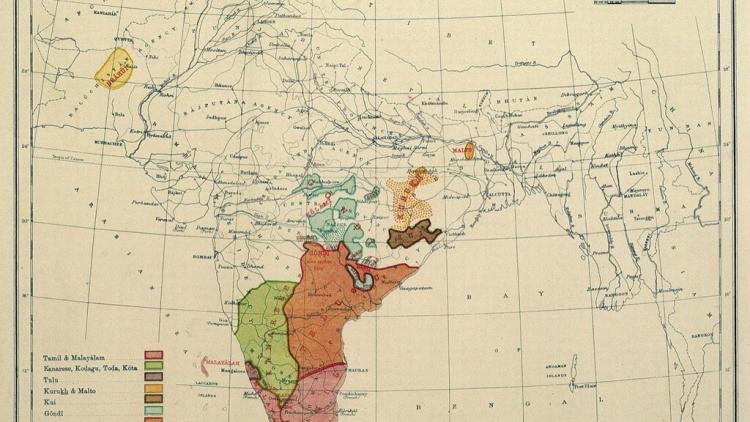

Image credit: John Tewell on Flickr: 'An artist rendition of Intramuros'. Artist: Fernando Brambila, Milan, Italy.